Wealth Management

NDR: Market Digest, October 2024 - U.S. equities: Strong Q3 for gold and stocks

Leading into the Fed's rate cut in Q3, markets experienced notable shifts across sectors and asset classes. Gold saw a strong surge, while oil's decline weighed down broader commodity indices. The S&P 500 outperformed the Dow Jones Industrial Average, driven in part by key tech stocks, while Utilities also posted impressive gains, benefiting from falling interest rates and investments in A.I. infrastructure. Overall, stocks and bonds both saw positive gains, marking a strong quarter for investors. But what does this mean for the broader market?

On a global scale, emerging markets led the way, while developed international markets experienced more modest growth. In the U.S., Value stocks outpaced Growth across various market segments. Smaller and mid-sized companies also posted strong results, outperforming their larger counterparts.

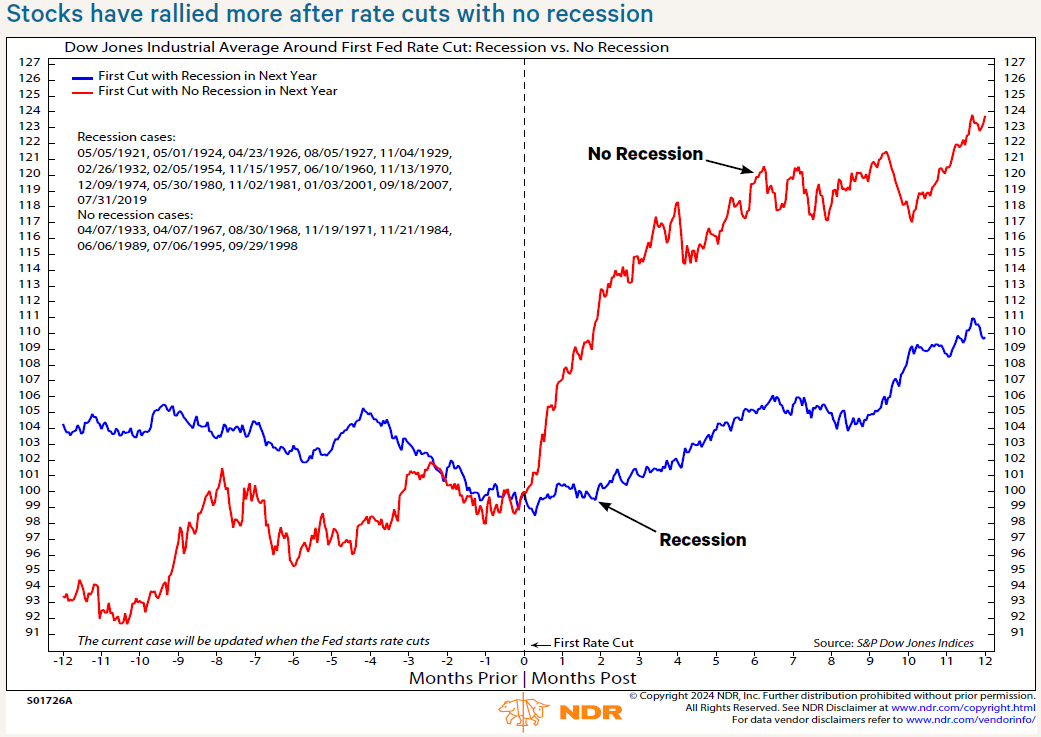

Historically, easing cycles into soft landings have been bullish for stocks (chart above), so all eyes are on the Fed. The continued strength in sectors like Tech and Utilities, coupled with the global performance of emerging markets, suggests that investors may see continued momentum, particularly in areas benefiting from macroeconomic shifts and innovation.

By submitting the form to the right, you will receive complimentary trial access to NDR’s full suite of investment research offerings and a digital copy of the Market Digest report.

Thank you for your interest in this excerpt from NDR’s Market Digest October 2024 publication titled “Let the easing cycle begin.” Request a complimentary copy of this timely, monthly macroeconomic research report for wealth professionals by completing the form to the right.

By submitting the form to the right, you will receive complimentary trial access to NDR’s full suite of investment research offerings and a digital copy of the Market Digest report.

If you have any questions about our investment solutions, you contact us at investmentsolutions@ndr.com. To learn more about our subscription services, you may email us at clientservices@ndr.com.

Best regards,

Ned Davis Research

www.ndr.com

About Ned Davis Research

Ned Davis Research (NDR) is a global provider of independent investment research, solutions and tools. Founded in 1980, NDR helps clients around the world make objective investment decisions. Our experienced strategists and analysts use fundamental and technical research with models, charts, indicators and weight-of-the-evidence methodology to help clients see the signals and invest with confidence. NDR is headquartered in Sarasota, Florida, with offices in New York and London.