Wealth Management

NDR: Report Download: Stock Allocations Near Record Highs — What Comes Next?

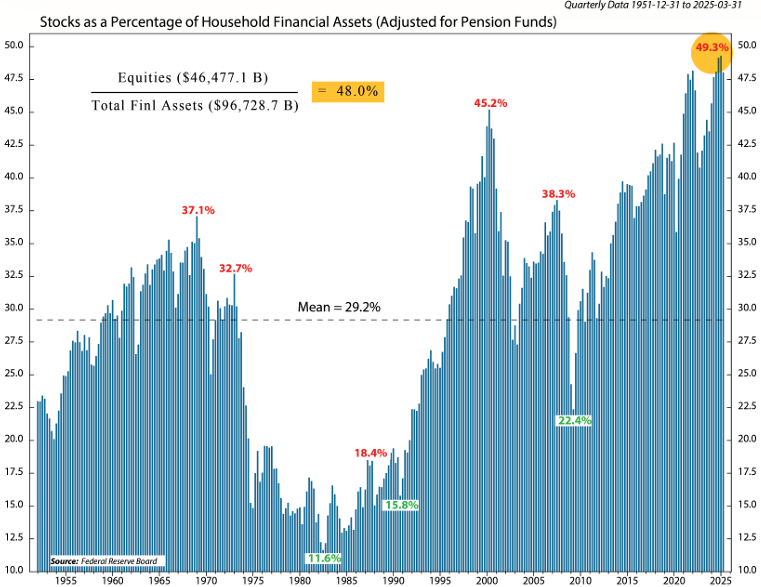

Investor stock allocations are hovering near record highs — not just among households, but also institutions and foreign buyers. While this may reflect optimism, history suggests it could be a warning sign.

The latest NDR Hotline explores how this elevated exposure to equities, combined with slowing buybacks and shifting global sentiment, could impact future market performance.

Inside this exclusive report:

- Insights on the latest NDR analysis of stock, bond, and cash allocations

- Foreign investment trends post "Liberation Day"

- Slowing corporate buybacks and what it means for demand

- Why high stock allocations could signal lower long-term returns

Thank you for your interest in this excerpt from NDR’s latest hotline: Near-record asset allocation to stocks. In a world where data integrity is no longer a given, how can investors maintain objectivity and confidence in their models? Download a complimentary copy of this timely and insightful report for wealth professionals by completing the form to the right.

If you have any questions about our investment solutions, you contact us at investmentsolutions@ndr.com. To learn more about our subscription services, you may email us at clientservices@ndr.com.

Best regards,

Ned Davis Research

www.ndr.com

About Ned Davis Research

Ned Davis Research (NDR) is a global provider of independent investment research, solutions and tools. Founded in 1980, NDR helps clients around the world make objective investment decisions. Our experienced strategists and analysts use fundamental and technical research with models, charts, indicators and weight-of-the-evidence methodology to help clients see the signals and invest with confidence. NDR is headquartered in Sarasota, Florida, with offices in New York and London.