Wealth Management

Rethinking Sentiment: Why Context Matters More Than Ever

Market sentiment indicators are a staple in many investors’ toolkits — but are they telling the full story?

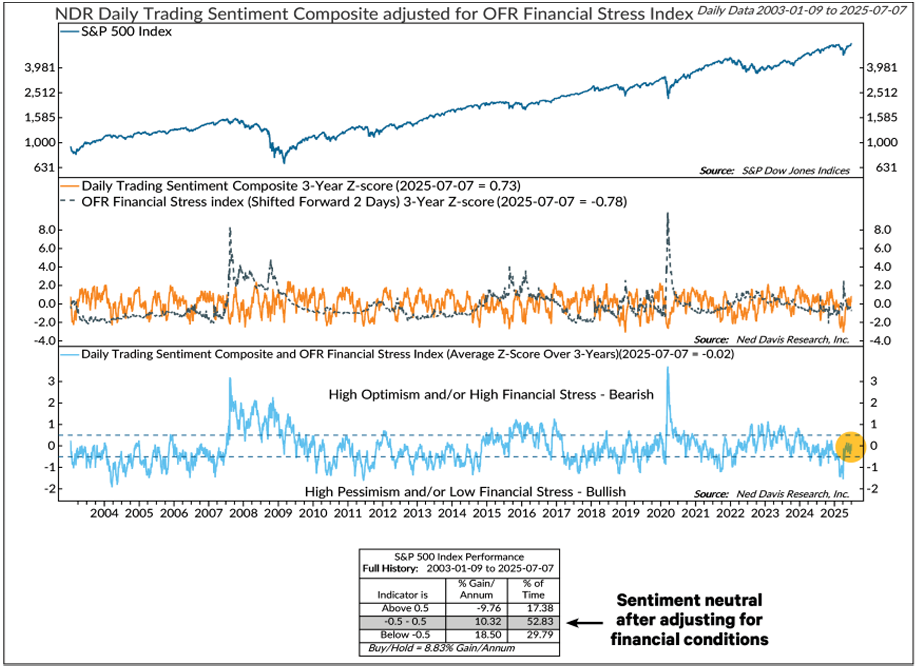

In the latest NDR Hotline, Joe Kalish, Chief Global Macro Strategist, explores a powerful enhancement to traditional sentiment analysis by adjusting our indicators for financial conditions. When liquidity is abundant, optimism needs to be much higher to signal risk. When financial conditions tighten, even mild optimism could be a red flag.

This fresh perspective applies a modern approach to traditional sentiment analysis and reveals how a simple adjustment can dramatically improve reliability — not just for equities, but for commodities and crude oil as well.

Inside this exclusive report:

- How financial stress reshapes sentiment signals

- Why traditional sentiment readings may be misleading

- A smarter way to interpret investor behavior across asset classes

Want to see how this adjustment changes the game?

Thank you for your interest in this excerpt from NDR’s latest hotline: Adjusting sentiment for financial conditions. In a world where data integrity is no longer a given, how can investors maintain objectivity and confidence in their models? Download the full report to explore the data, methodology, and results by completing the form to the right.

If you have any questions about our investment solutions, you contact us at investmentsolutions@ndr.com. To learn more about our subscription services, you may email us at clientservices@ndr.com.

Best regards,

Ned Davis Research

www.ndr.com

About Ned Davis Research

Ned Davis Research (NDR) is a global provider of independent investment research, solutions and tools. Founded in 1980, NDR helps clients around the world make objective investment decisions. Our experienced strategists and analysts use fundamental and technical research with models, charts, indicators and weight-of-the-evidence methodology to help clients see the signals and invest with confidence. NDR is headquartered in Sarasota, Florida, with offices in New York and London.