Wealth Management

NDR: Market Digest, July 2024 - Mid-Year Outlook

We remain bullish on U.S. stocks due to accelerating earnings growth, moderating economy and inflation, and expectations of a year-end rally in a presidential election year. The S&P 500's 15.0% year-to-date gain has led to stretched valuations and an overbought market, with narrowing market breadth signaling susceptibility to significant drawdowns.

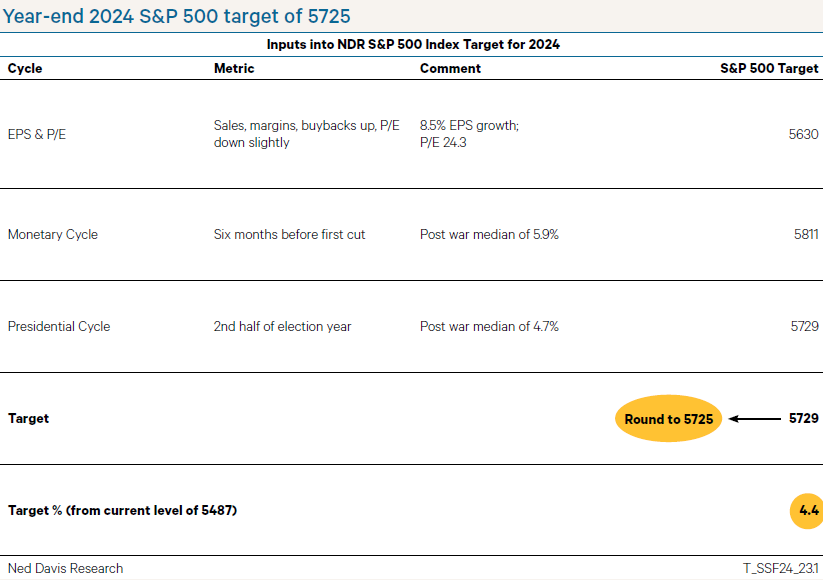

We have raised our year-end S&P 500 target to 5725, increasing our top-down operating earnings-per-share estimate from 6.5% to 8.5% (table above). This is due to raised forecasts for GDP and inflation, improved profit margins, and significant stock buyback plans by mega-cap companies. We’ve also shifted to favoring Growth over Value and large-caps over small-caps due to technical action supported by earnings growth and a slowing economy. Changes in inflation and Fed policy could necessitate another tactical shift.

Thank you for your interest in this excerpt from NDR’s Market Digest July 2024 publication titled “2024 Mid-Year Outlook.” Request a complimentary copy of this timely, monthly macroeconomic research report for wealth professionals by completing the form to the right.

By submitting the form to the right, you will receive complimentary trial access to NDR’s full suite of investment research offerings and a digital copy of the Market Digest report.

If you have any questions about our investment solutions, you contact us at investmentsolutions@ndr.com. To learn more about our subscription services, you may email us at clientservices@ndr.com.

Best regards,

Ned Davis Research

www.ndr.com

About Ned Davis Research

Ned Davis Research (NDR) is a global provider of independent investment research, solutions and tools. Founded in 1980, NDR helps clients around the world make objective investment decisions. Our experienced strategists and analysts use fundamental and technical research with models, charts, indicators and weight-of-the-evidence methodology to help clients see the signals and invest with confidence. NDR is headquartered in Sarasota, Florida, with offices in New York, London, and Hong Kong.