Wealth Management

NDR: Economic data on growth and inflation is very mixed.

NDR's current view on Economic data on growth and inflation is mixed. We have below-trend but still decent growth this year and that CPI will be sticky around 3%. Recent data has shown that things could be slightly less favorable for growth and slightly better for inflation.In Q1, real GDP growth underwent a downward revision to 1.3% from the initial estimate of 1.6%, albeit slightly better than the consensus projection of 1.2%. This downward adjustment was primarily driven by softer consumer spending, particularly on durable goods, and a more significant decline in inventory investment. Despite the slowdown, final sales to domestic purchasers, which exclude inventories and net exports, maintained a steady pace, rising at a 2.5% annualized rate. This indicates a resilient underlying domestic demand, essential for sustaining economic expansion, albeit at a slower pace compared to the previous year. As a result, we upgraded our projection for 2024 real GDP growth by 50 basis points to 1.5%-2.0%.

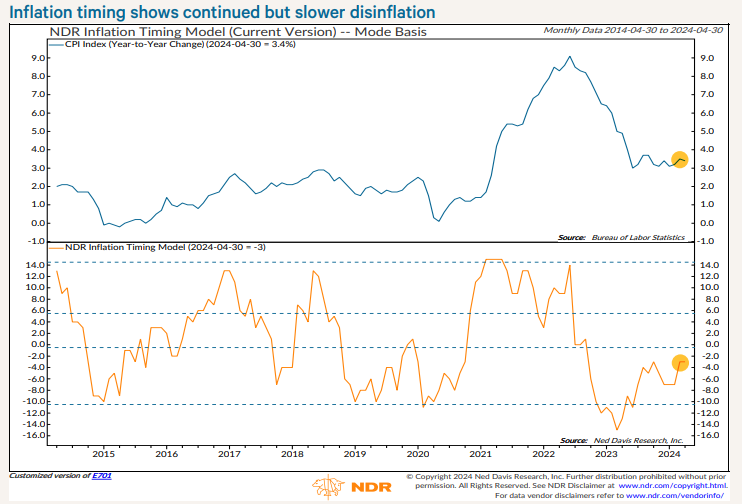

Moving further into 2024, we anticipated a significant moderation in economic growth due to several factors, including the lagged impact of Federal Reserve tightening, slower consumer spending amid labor market rebalancing, signs of financial stress, and diminishing excess savings. Although the economy is still on a slowing growth trajectory, a somewhat firmer demand than previously projected feeds into slightly firmer inflation, as well. Therefore, we revised our forecast for 2024 CPI inflation upward by 25 basis points to 2.75%-3.25%, reflecting a slower path to the Fed’s inflation target. While our Inflation Timing Model suggests continued disinflation (chart above), elevated PMI output price indexes, along with other factors, suggest sticky inflation in the near term.

Stay tuned for more insights from NDR as we delve deeper into the dynamics shaping the economic landscape and offer actionable strategies for investors. Let us help you See the Signals.™