Chart of the Week

NDR: Why have stocks rallied despite higher rates?

One of NDR’s themes over the past two years has been that higher interest rates make stocks less attractive than bonds. Many of our clients have pondered, "Why not allocate some to fixed income when I can get over 4% from bonds and over 5% from cash?"

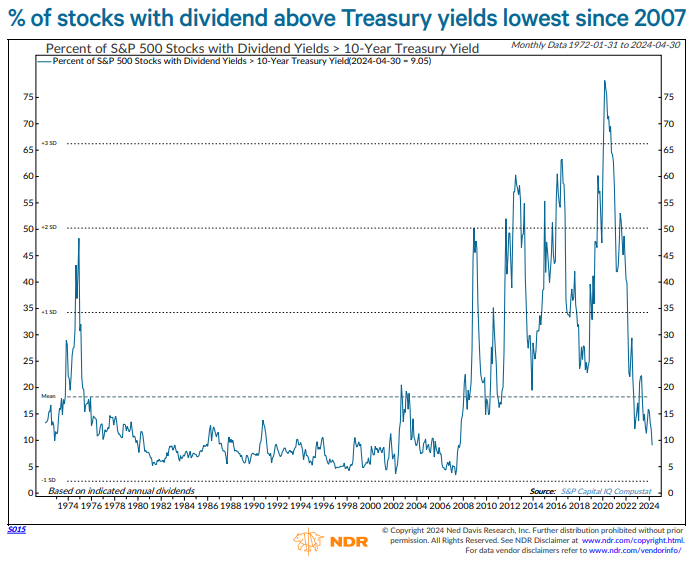

How do we answer? We look at the data. This chart illustrates the transition very well. The percentage of S&P 500 stocks with dividend yields above the 10-year Treasury yield has fallen from a record high of 78.2% in March 2020 to 9.1% as of April 30. The last time the percentage was this low was September 2007, just days before the S&P 500 peaked ahead of the financial crisis. For income-seeking investors

especially, the bond market represents a more-than-reasonable alternative.

So, why have stocks rallied despite higher rates? The data points to three considerations.

The first reason stocks have continued to rally despite juicy bond yields is that economic growth, and therefore earnings growth, has been solid. Widespread calls for recession have kept some investors on the sidelines, creating a wall of worry for the market to climb.

Second, while relative valuations are the least attractive for stocks in over a decade, several indicators have corrected back to their prefinancial crisis ranges.

Third, dividends do not tell the entire story of how companies return capital to shareholders. S&P 500 net repurchases have exceeded dividends for all but six quarters since 2011.

Stay tuned for more insights from NDR as we delve deeper into the dynamics shaping the economic landscape and offer actionable strategies for investors. Let us help you See the Signals.™