Chart of the Week

NDR: Trade war concluding?

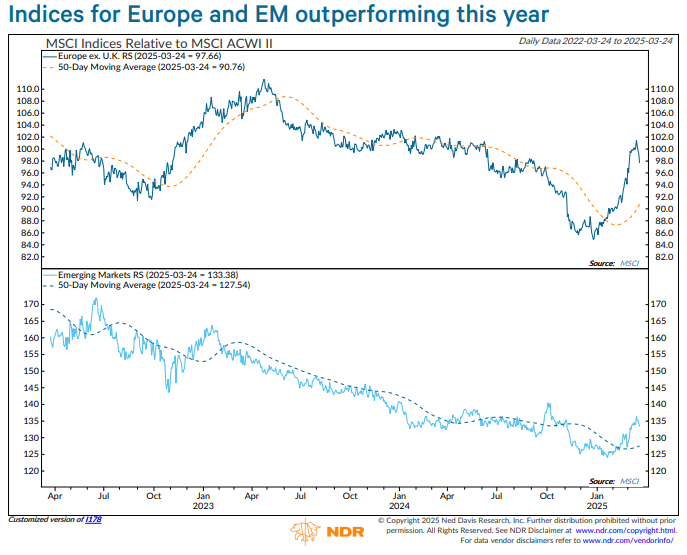

Following the Trump-driven rally that pushed equities to record highs, trade war fears in February-March triggered excessive pessimism, leading to U.S. mega-cap selloffs, MSCI U.S. underperformance, and a weaker dollar. Meanwhile, Europe ex-U.K. and emerging markets (chart above) benefited, along with gold, while Tech stocks lagged. This led to position shifts, including a bearish dollar stance, a move from cash to bonds, and reallocations that downgraded the U.S. to marketweight while upgrading Emerging Markets.

However, despite speculation of a global leadership shift, there’s insufficient evidence for further reallocation. If breadth thrust signals confirm a bottom, Tech and the U.S. could regain strength, tempering gains in Europe and emerging markets.

Want deeper insights and data to inform your strategy? Sign up for a complimentary trial of the NDR platform and explore our full range of research tools by completing the form to the right. Delve deeper into the dynamics shaping the economic landscape and offer actionable strategies for investors. Let us help you, See the Signals.™ To subscribe to the NDR Blog click here.

Ned Davis Research, Inc. (NDR), or any affiliates or employees, or any third-party data provider, shall not have any liability for any loss sustained by anyone who has relied on the information contained in any NDR publication. The data and analysis contained herein are provided “as is.” NDR disclaim any and all express or implied warranties, including, but not limited to, any warranties of merchantability, suitability or fitness for a particular purpose or use. Past recommendations and model results are not a guarantee of future results. Using any graph, chart, formula or other device to assist in deciding which securities to trade or when to trade them presents many difficulties and their effectiveness has significant limitations, including that prior patterns may not repeat themselves continuously or on any particular occasion. In addition, market participants using such devices can impact the market in a way that changes the effectiveness of such device. This communication reflects our analysts’ opinions as of the date of this communication and will not necessarily be updated as views or information change. All opinions expressed herein are subject to change without notice. NDR, or its affiliated companies, or their respective shareholders, directors, officers and/or employees, may have long or short positions in the securities discussed herein and may purchase or sell such securities without notice.