Chart of the Week

NDR: To Sell or not to sell in May? Challenging the cliché.

Does a strong summer rally challenge the old saying, “sell in May and go away?”

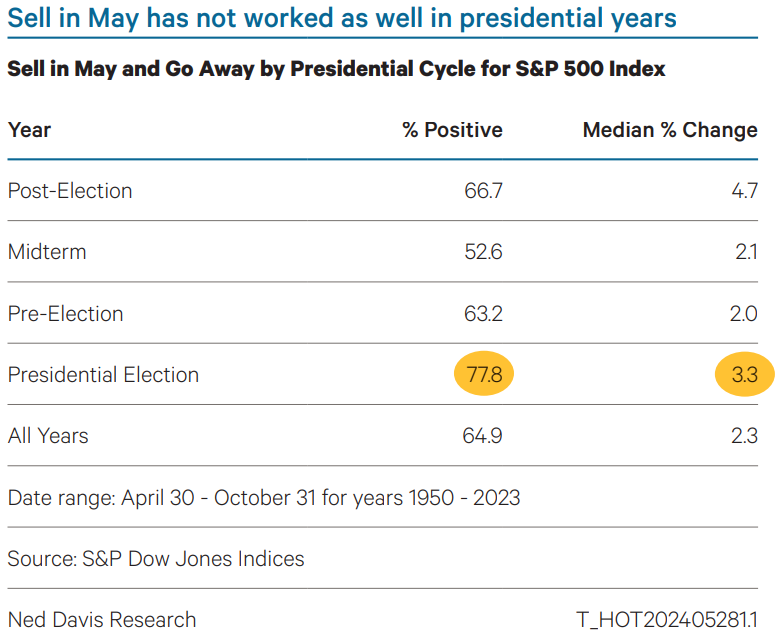

Historically, the “sell in May” cyclical influence has not been as powerful during election years. Since 1950, the S&P 500 has risen 77.8% of the time from April 30 - October 31 in election years, the highest of the four presidential years. What we’re seeing is the “sell in May” strategy has worked less and less in recent years, regardless of the presidential cycle. Since 2012, the S&P 500 has risen 10 out of 12 times by a median of 3.0%. The NDR S&P 500 cycle composite suggests a summer rally, keeping consistent with most of our models.

Stay tuned for more insights from NDR as we delve deeper into the dynamics shaping the economic landscape and offer actionable strategies for investors. Let us help you See the Signals.™