Chart of the Week

NDR: Restrictive for longer

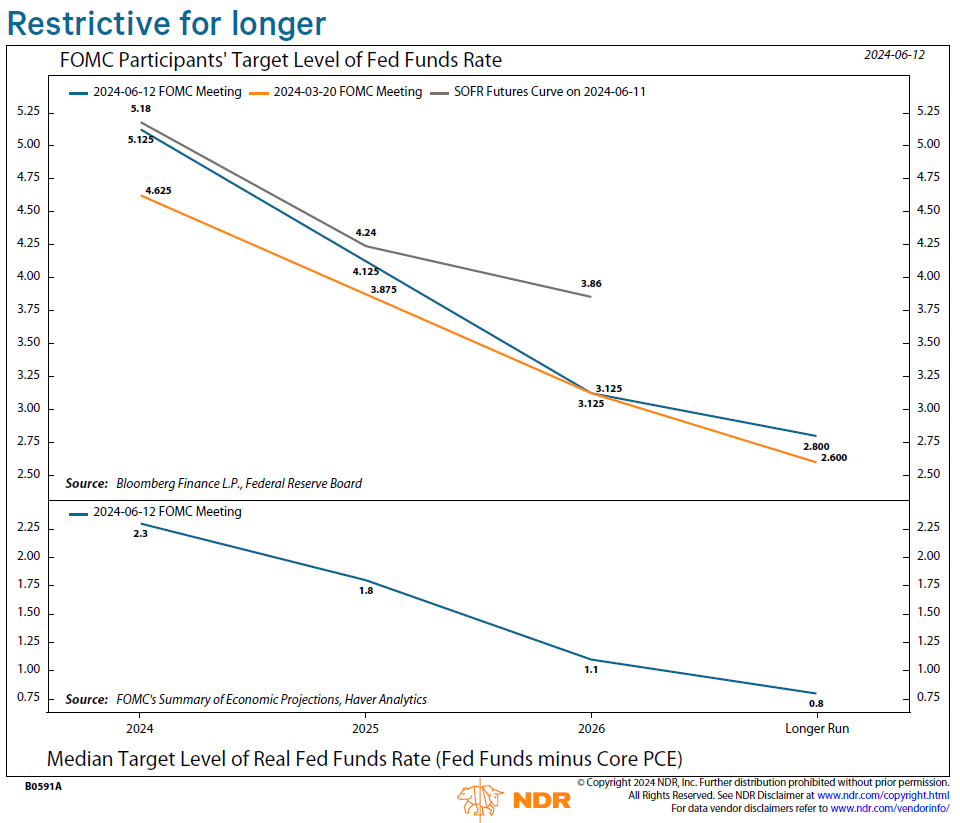

As expected, the FOMC left the fed funds target range at 5.25% to 5.50% for the seventh consecutive meeting. Powell gave no clear indication as to when a rate cut would come. Which begs the question, when might we see a cut?

We reiterate our call for one rate cut after the election, probably in December. Additional downside surprises in inflation or an unexpected jump in unemployment this summer could put September in play.

The inflation projections presented some puzzling aspects. Core PCE saw an increase from 2.6% to 2.8%, aligning with April's figures and potentially decreasing this month, particularly after the latest CPI report. Meanwhile, the Headline PCE was adjusted from 2.4% to 2.6%, slightly below April's 2.7%. Powell acknowledged that base effects might hinder progress in the latter part of the year, although he viewed Wednesday's CPI report as a positive step forward. With the median 2024 dot now at 5.125% and core PCE inflation at 2.8%, the real fed funds rate is anticipated to stay restrictive at 2.3%.

Projections suggest it will decrease to 1.8% next year.

Stay tuned for more insights from NDR as we delve deeper into the dynamics shaping the economic landscape and offer actionable strategies for investors. Let us help you See the Signals.™