Chart of the Week

NDR: When bonds become superior to equities

Fed easing is a matter of timing and NDR’s historical studies show yields have always declined in the 3-months before the first rate cut. But most clients take a more holistic view, whether it be a simple 60/40 portfolio or a more complex multi-asset allocation decision.

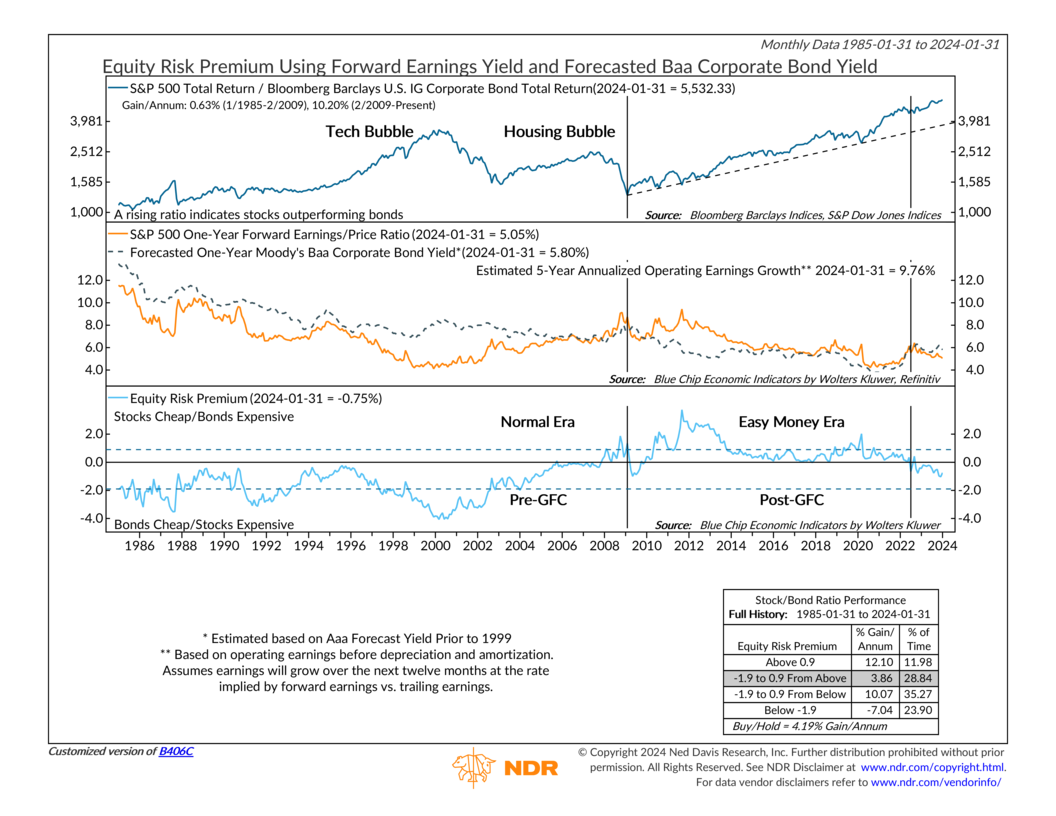

Our preferred relative valuation metric between bonds and stocks is a forward-looking ERP. Here we compare the 1-year forward earnings yield for the S&P 500 with the 1-year forecasted Baa corporate bond yield (middle clip) and plot the difference (bottom clip). We also plot the relative total return ratio between the S&P 500 and the Bloomberg IG Corporate Bond Index (top clip). When the ratio is rising, equities are outperforming IG corporates and vice versa.

Our analysis also shows that on a fundamental basis, when bond yields exceed earnings yields by nearly 200 bps, equities are vulnerable and bonds are the better bet. In fact, the ratio falls at a 7% p/a rate - not the condition we have today. To access the full publication please fill out the form to the right, or click here to participate in our trial program.