Chart of the Week

NDR: Unlocking Investor Psychology: A Closer Look at NDR's DAVIS265

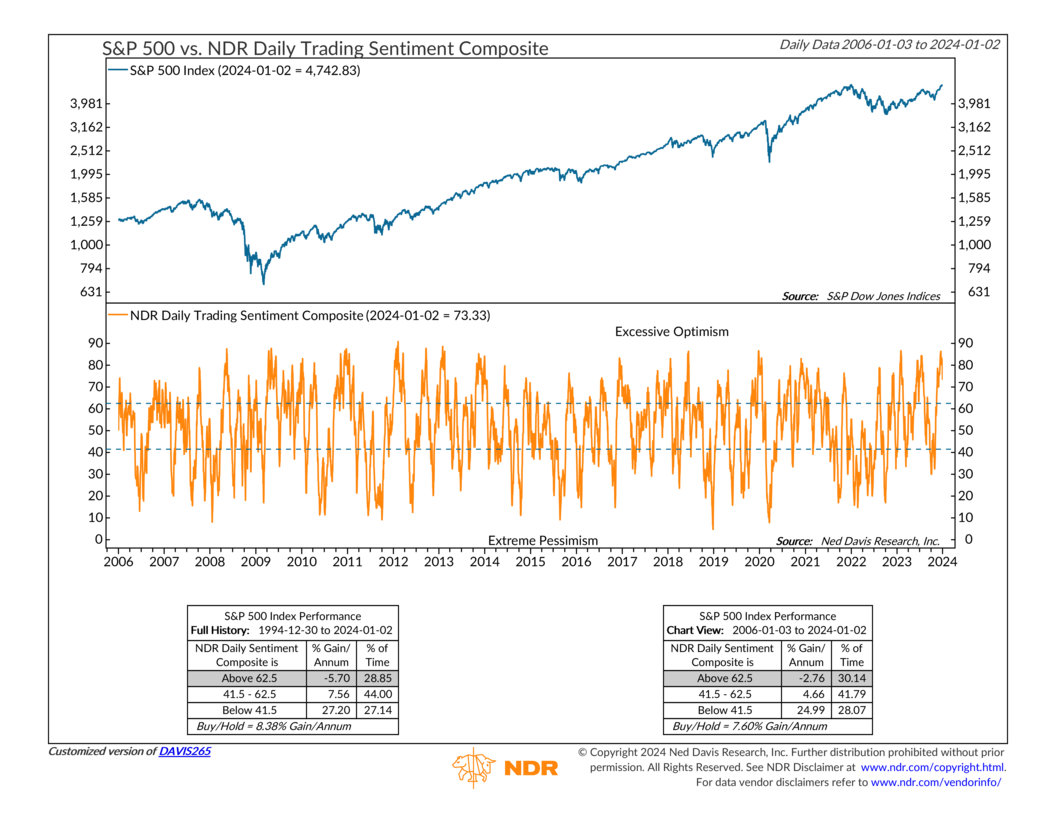

NDR’s S&P 500 vs. Daily Trading Sentiment Composite that we know as ‘DAVIS265’

So, what is it?

DAVIS265 is a sentiment indicator designed to highlight short-term swings in investor psychology. It combines a number of individual indicators in order to represent the psychology of a broad array of investors to identify trading extremes that may be used for contra or hedging trades. The NDR Daily Trading Sentiment Composite is comprised of daily and weekly model readings. All readings have been converted to a daily frequency and the most recent weekly values are repeated for the daily calculations. The indicators have been selected from sentiment, asset flow, overbought/oversold, valuation, volatility, and put/call areas of market analysis.

To learn more on how to incorporate NDR’s market sentiment analysis into your workflow, fill in the form to the right and we'll be in touch shortly.