Chart of the Week

NDR: The Counter to Unprofitable Anxiety

"The degree of unprofitable anxiety in an investor’s life corresponds directly to the amount of time one concentrates on how the market should be acting rather than the way it actually is acting.” - Ned Davis, , Senior Investment Strategist.

While many investors were cautious coming into 2023 as they focused on how the market should be acting in the face of a potential recession and Fed tightening, a series of technical indicators provided the NDR team with the confidence to remain constructive on equities. Ned highlighted the first breadth thrust buy signal from 10-day advances/10-day declines on 7/27/2022 and it was confirmed by additional signals in October and February. Over this period, we received further validation with a buy signal from the NDR Leading Indicator model in December 2022 and our flagship Global Balanced Account Model also turned bullish. Our Chief Global Investments Strategist Tim Hayes therefore moved to an overweight stance on global equities on 12/1/22 and Chief U.S. Strategist Ed Clissold followed in January.

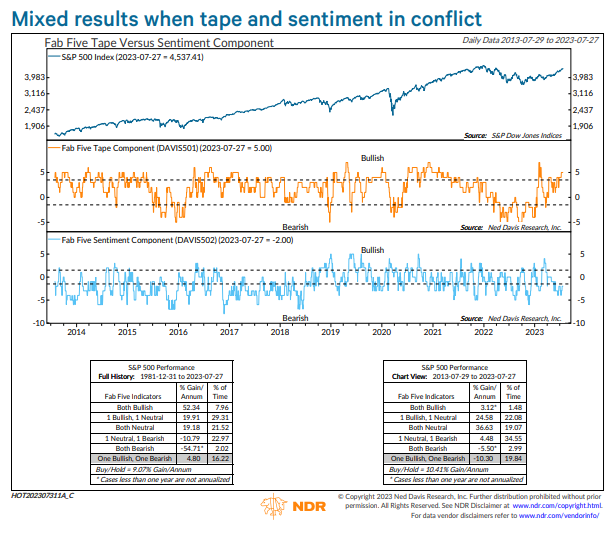

What’s next? The bullish tape has now been contradicted by a negative sentiment backdrop. As illustrated below, performance has historically been choppy when the tape and sentiment picture are in conflict. Also, while NDR uses technical analysis extensively to "let our winners run and cut our losses short", our weight of the evidence approach also factors in inflation, valuation and Fed Policy. As Ned noted in his 7/31/23 Hotline, “the easy part of the disinflation fight is over for a while, and valuations and Fed policy cause me to stay alert”. To learn more about NDR's methodology and positioning for the remainder of this year, please complete the form to the right and a member of our team will be in touch.