Chart of the Week

NDR: Earnings-driven strength supports soft landing scenario

Since last month’s yield downturn several of NDR’s daily sentiment gauges have reversed higher from pessimistic extremes. Suggesting bond investors have regained confidence that yields will remain stable to lower, and equity investors are more hopeful that with rates receding, the earnings recovery will remain intact. The beat rate for MSCI U.S. is running at an encouraging +80% following reports from most constituents. Earnings growth has turned upward from extremes this year for most regional indices, and consensus estimates indicate more improvement next year.

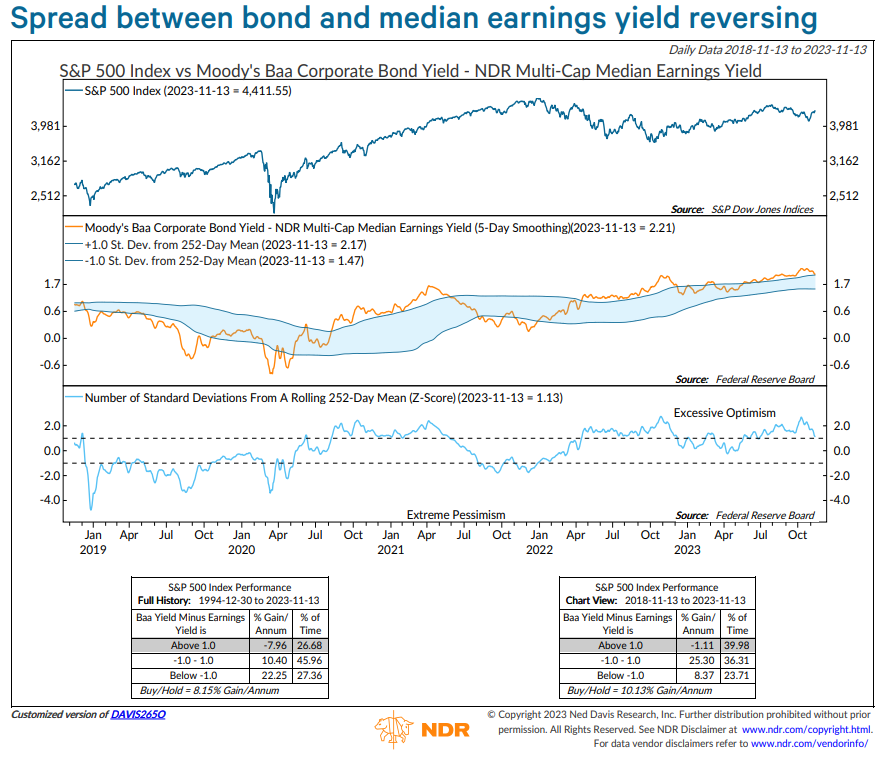

Whilst excessive earnings optimism could be a potential risk in 2024, the current earnings growth recovery is positive not only for its influence in pulling sceptics back into the market, but also for its influence on valuations. The chart above uses the Moody’s Baa corporate bond yield and the median earnings yield of stocks in the NDR Multi-Cap universe. It shows the spread has narrowed since the October bottom after widening during the correction, with the indicator now close to dropping out of its bearish mode for equities. In the ideal scenario, bond yields would continue to decline, earnings growth would continue to support earnings yields, and the spread would keep narrowing, consistent with an economic soft landing. To access the full publication please fill out the form to the right, or click here to participate in our trial program.