Chart of the Week

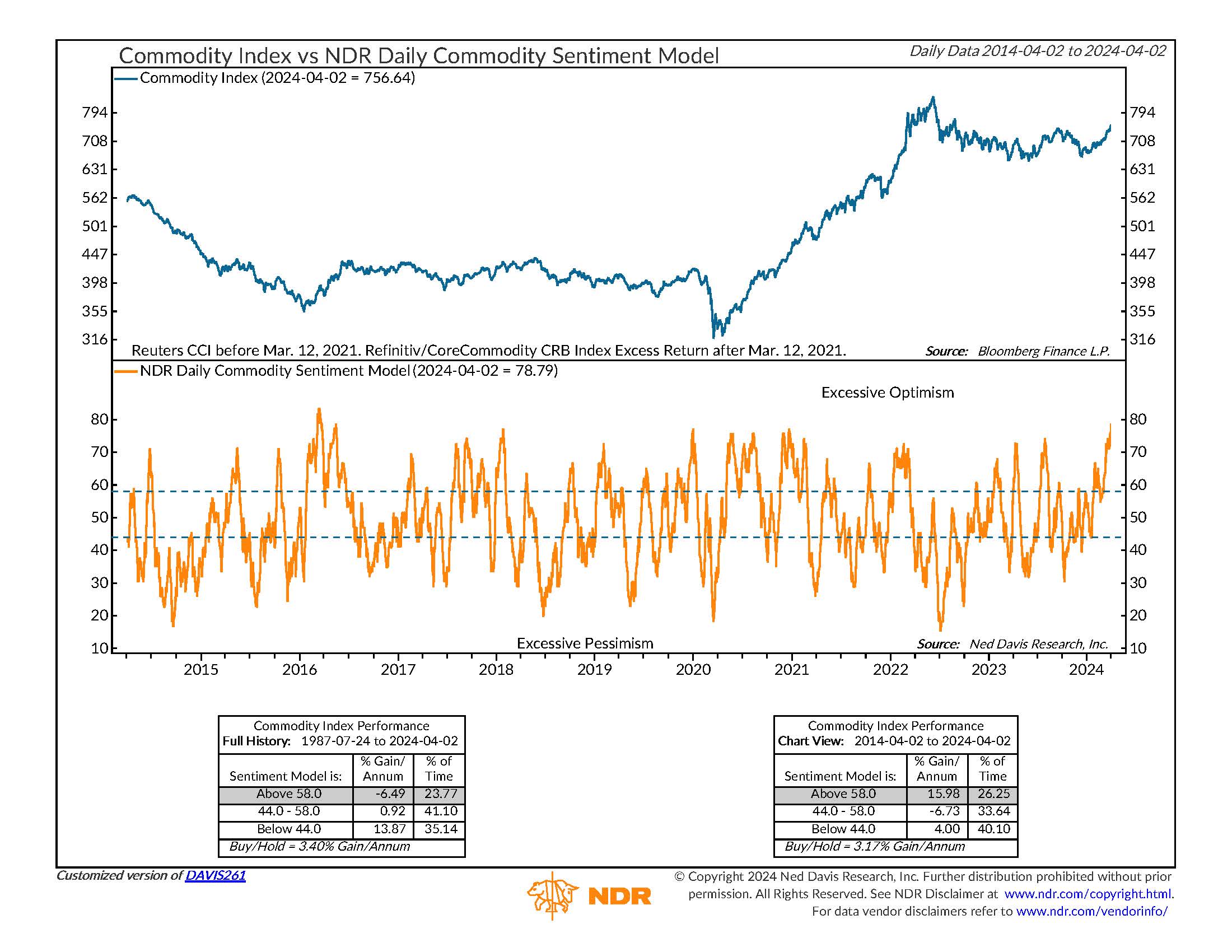

NDR: Daily Commodity Sentiment Model - A Surge in Optimism

In our latest update, we're excited to report a surge in optimism with the NDR Daily Commodity Sentiment Model reaching its highest level since March 2016. Last month, we observed a return to optimism, but sentiment continued to climb throughout, reaching new heights.

It's important to note that elevated sentiment alone isn't a reason to turn bearish. Historically, excessive optimism has often coincided with above-average returns over the past decade. However, this trend is significantly influenced by the robust rally following the Covid-induced lows.

When we exclude the rally from 2020 to 2022, the statistics paint a more traditional picture. In these cases, excessive optimism tends to correlate with below-average returns. Despite this, it's essential to stay vigilant and consider various factors when assessing market sentiment.

Our team continues to monitor these developments closely, providing insights and analysis to help navigate the ever-changing market landscape. Stay tuned for further updates and insights from NDR as we delve deeper into market sentiment and its implications for investors.