Chart of the Week

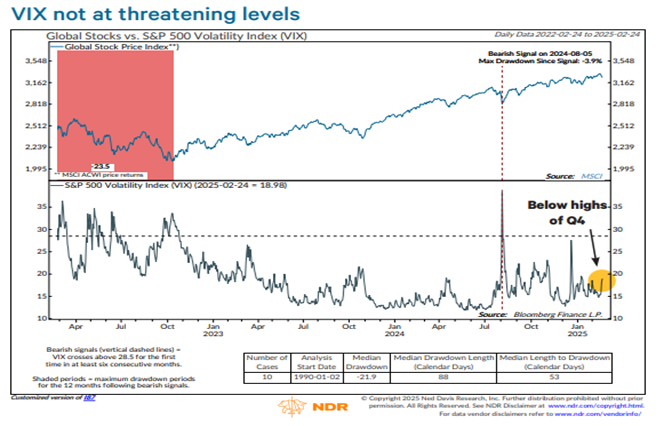

NDR: Volatility remains in check

Geopolitical tensions continue to rise, fueling ongoing speculation about tariffs and trade policies. Equities have remained under pressure, yet this hasn’t triggered a surge in volatility. The VIX remains well below the levels seen in the fourth quarter (chart above), and realized volatility has been relatively stable. This is reflected in our 100-Day Volatility Index for the S&P 500 and the average volatility of the 23 country components within the MSCI World Index.

One possible reason for the relative volatility containment is that, despite inflation concerns, the 10-year Treasury yield has dropped to a new low for the year. Meanwhile the Global Aggregate Bond Yield has stayed within its 2025 trading range. Additionally, despite fears of slowing growth, the current earnings season has been largely positive.

Want deeper insights and data to inform your strategy? Sign up for a complimentary trial of the NDR platform and explore our full range of research tools by completing the form to the right. Delve deeper into the dynamics shaping the economic landscape and offer actionable strategies for investors. Let us help you, See the Signals.™