Chart of the Week

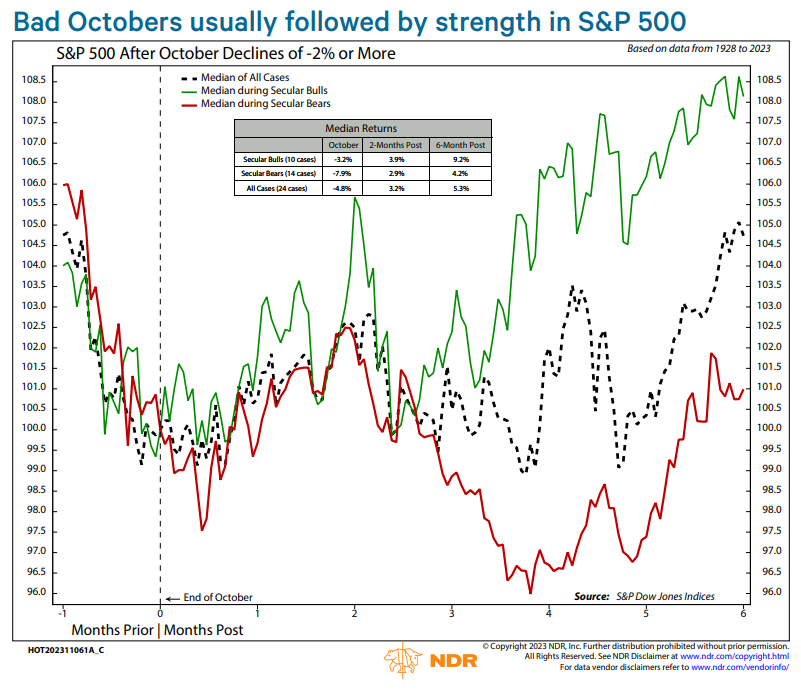

NDR: Bad Octobers usually followed by strength in S&P 500

Was the October weakness a warning that favorable Nov-Dec seasonal tendencies won’t hold up this year? Tim Hayes, NDR’s Chief Investment Strategist, studied October declines of -2% or more in the S&P 500 since 1928, and found that a bad October hasn’t usually been a bearish omen. Over the following 2-months the S&P 500 has had a median gain of +3.2%, and rallying normally continues into the following year, with median gains of +5.3% over the 6-months following October declines. This tendency has been especially strong when equities have been in a secular bull market. Here the median S&P 500 gain was +9.2, over twice the returns than during secular bears.

Whilst the above is encouraging, the case for rallying will gain more significant support if we start to see breadth thrust signals from our technical indicators, followed by bullish readings on longer-term breadth indicators. But considering the positive seasonal influences, plus the market’s record after bad Octobers, equities have entered a window of opportunity for such improvement. To access the full publication please fill out the form to the right, or click here to participate in our trial program.