Chart of the Week

NDR: Armchair technical analysts doing it wrong

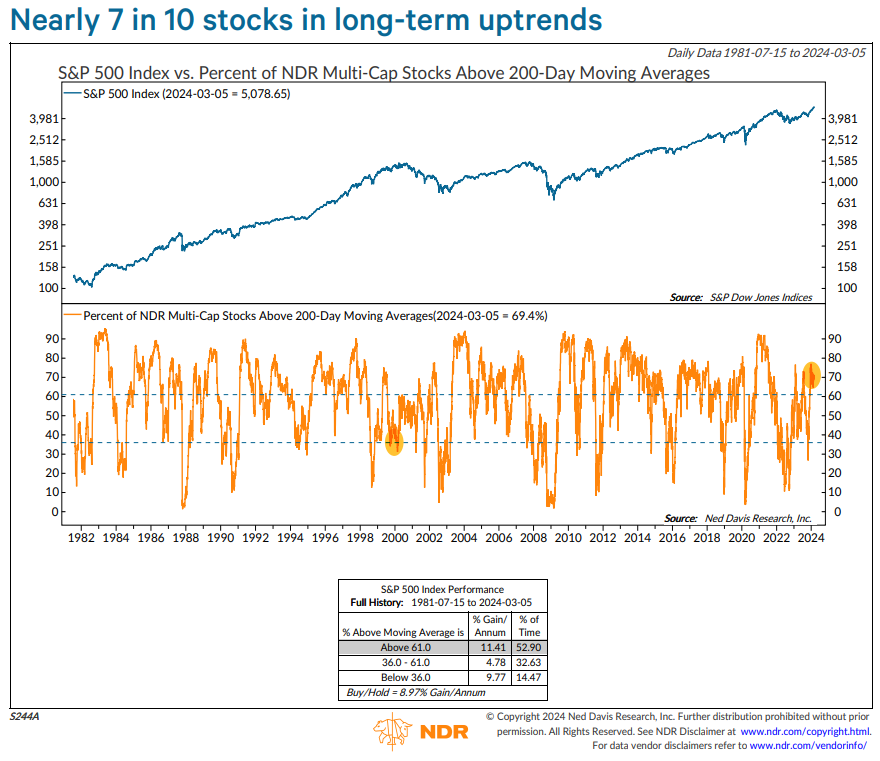

Major benchmark indices are off to a strong start in 2024. From their October lows the S&P, Dow Industrials, and NASDAQ are all up 19%+ to all-time highs. But investors remain concerned that most of the gains can be attributed to a handful of stocks, many of which rallied on AI excitement and now sport high P/Es.

On the surface, the bears make a good point - a narrow market is a dangerous one. The ends of bull markets are often defined by a few stocks in uptrends and the rest in downtrends. But what they’re perhaps missing is the difference between relative and absolute performance. If mega-cap tech stocks were the only ones rallying and rest declining, their concerns would be valid. But that isn’t the case currently. Nearly 70% of stocks in NDR's Multi-Cap universe are above their 200-day moving averages. Whereas at the 3/24/2000 peak in the S&P, only 45% of stocks were above. The percentage fell as low as 31.2% in Feb 2000. To access the full publication please fill out the form to the right, or click here to participate in our trial program.

#NedDavisResearch #InvestmentResearch