Chart of the Week

NDR: Mythbusting Market Timing

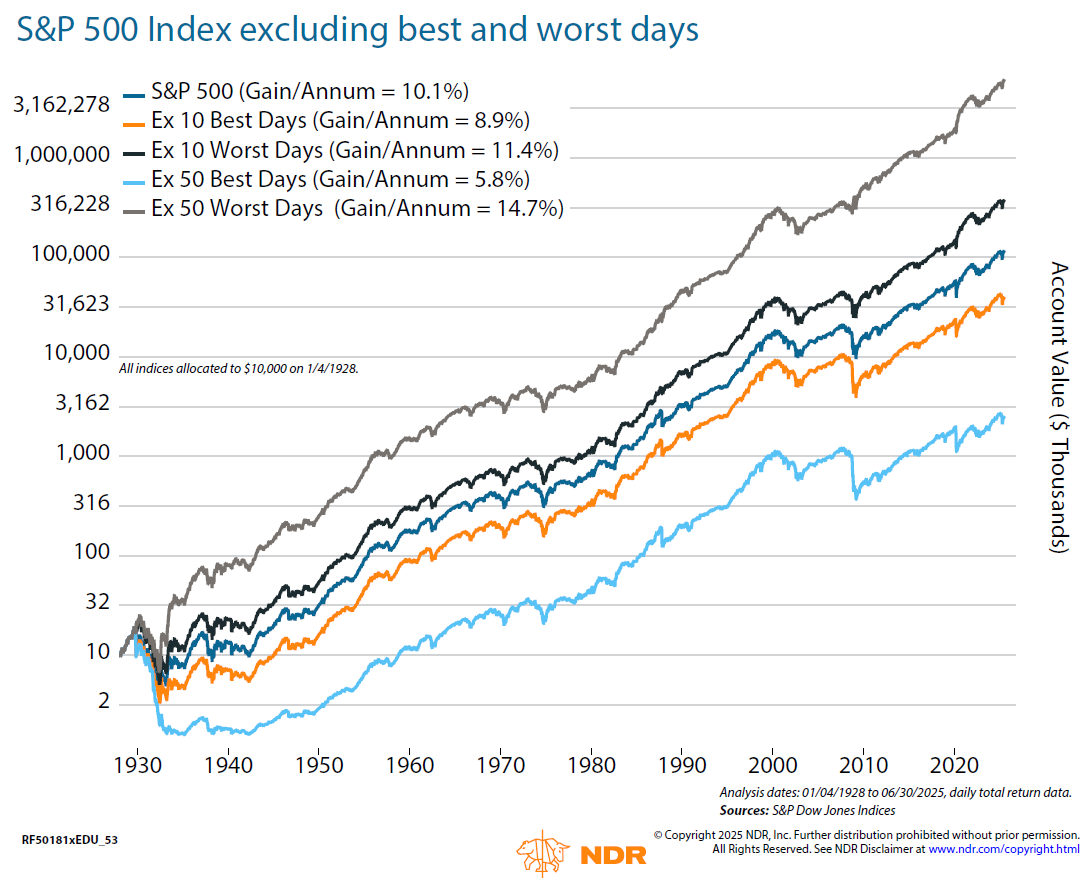

In the latest edition of NDR’s Integrated Analyst, the Custom Research Solutions (CRS) team takes a critical look at one of the most cited arguments against market timing: the idea that missing just the 10 best days in the market can drastically reduce long-term returns.

While the data behind this claim is technically accurate, the broader context reveals a more nuanced reality.

The report goes further by examining when these best and worst days actually occur. Surprisingly, most of them are clustered during periods of extreme volatility—such as the Great Depression, the 2008 financial crisis, and the COVID-19 pandemic. In fact, many of the best and worst days happen within bear markets, often just days apart. This proximity suggests that market timing strategies are unlikely to miss only the best days or avoid only the worst. Instead, both tend to come as a package deal during turbulent times.

Ultimately, NDR concludes that the “10 Best Days” argument oversimplifies the complexity of market behavior. While it’s statistically improbable to miss only the best or worst days, the real goal of market timing is to sidestep prolonged downturns—not just a handful of volatile sessions. For investors with the right tools and risk tolerance, market timing remains a viable strategy. The takeaway? Don’t let catchy statistics dictate your investment philosophy—dig deeper, question assumptions, and consider the full picture.

Thank you for your interest in this excerpt from NDR’s Integrated Analyst - July 2025 edition, a quarterly publication showcasing the wide-ranging capabilities of NDR’s Custom Research Solutions (CRS) group. CRS can serve as an extension of your research team to assist with projects large or small. We build tailored solutions through direct engagement. Request a complimentary copy of this quarterly research report by completing the form to the right (For use by professional investors only).

To learn more about NDR’s Custom Research Solutions visit us online, click here.

Stay tuned for more insights from Ned Davis Research as we delve deeper into the dynamics shaping the economic landscape and offer actionable strategies for investors. Let us help you See the Signals.™