Chart of the Week

NDR: Market Momentum

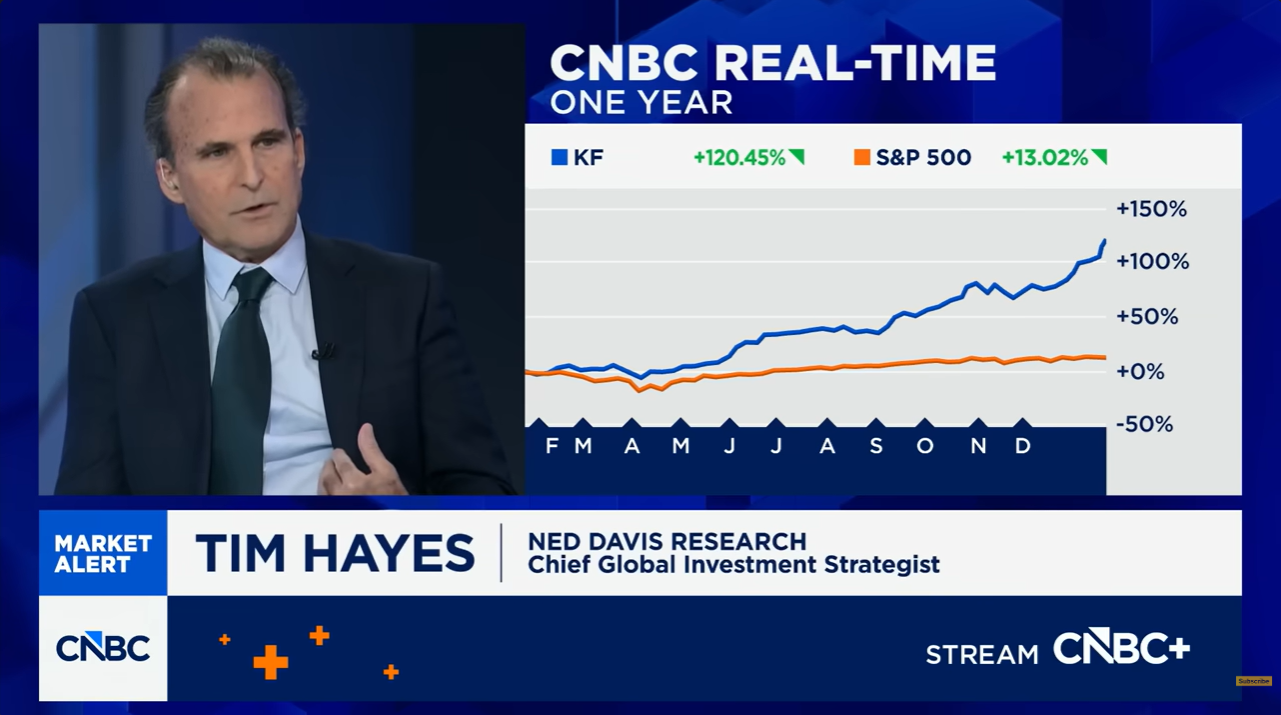

In a recent appearance on Closing Bell Overtime, Tim Hayes, Chief Global Investment Strategist at Ned Davis Research, broke down the forces shaping today’s markets—from a remarkably long U.S. bull run to the renewed strength across emerging economies. Which leaves investors asking: Can this momentum continue?

Tim described the current U.S. equity bull market as unusually mature—twice the length of the historical median and now the ninth longest since 1900. While headline indices remain strong, he noted weakening market breadth and growing complacency among investors, leaving the market vulnerable as it heads into a pivotal earnings season. Hayes emphasized that the market still needs renewed momentum to sustain another leg higher.

In contrast, Hayes highlighted broad-based strength across emerging markets. Over the past year, developments such as improving EM currencies, attractive valuations—especially in tech—and resilience during U.S. market softness have fueled EM outperformance. Countries like Taiwan, South Korea, Brazil, and South Africa have benefited from both tech leadership and commodity tailwinds. EM tech, in particular, has reached new highs even as U.S. tech has lagged, suggesting investors are rotating into better-value growth opportunities abroad.

Despite concerns about U.S. market maturity, Hayes said NDR continues to maintain a modest overweight in equities in keeping with its “don’t fight the tape, don’t fight the Fed” philosophy. With the Federal Reserve leaning more accommodative, Hayes sees potential for markets to push higher—provided earnings deliver or momentum revives in the weeks ahead.

Want deeper insights and data to inform your strategy? Sign up for a complimentary trial of the NDR platform and explore our full range of research tools by completing the form to the right. Delve deeper into the dynamics shaping the economic landscape and offer actionable strategies for investors. Let us help you, See the Signals.™ To subscribe to the NDR Blog, click here.

Ned Davis Research, Inc. (NDR), or any affiliates or employees, or any third-party data provider, shall not have any liability for any loss sustained by anyone who has relied on the information contained in any NDR publication. The data and analysis contained herein are provided “as is.” NDR disclaim any and all express or implied warranties, including, but not limited to, any warranties of merchantability, suitability or fitness for a particular purpose or use. Past recommendations and model results are not a guarantee of future results. Using any graph, chart, formula or other device to assist in deciding which securities to trade or when to trade them presents many difficulties and their effectiveness has significant limitations, including that prior patterns may not repeat themselves continuously or on any particular occasion. In addition, market participants using such devices can impact the market in a way that changes the effectiveness of such device. This communication reflects our analysts’ opinions as of the date of this communication and will not necessarily be updated as views or information change. All opinions expressed herein are subject to change without notice. NDR, or its affiliated companies, or their respective shareholders, directors, officers and/or employees, may have long or short positions in the securities discussed herein and may purchase or sell such securities without notice.