Chart of the Week

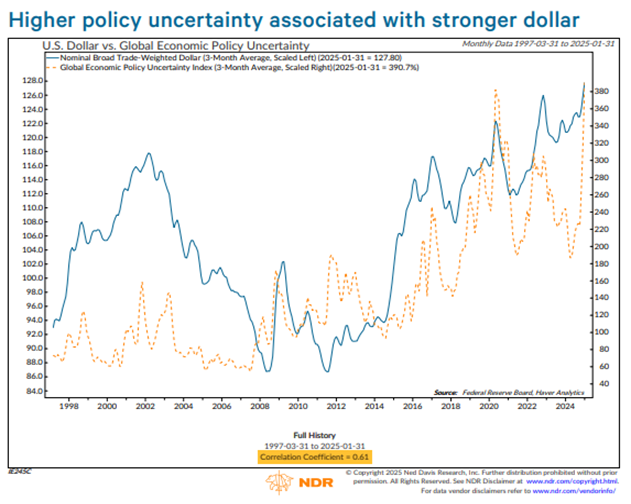

NDR: Global uncertainty leading to strong U.S. dollar?

U.S. President Trump has frequently advocated for a weaker dollar, aiming to address the nation’s significant trade deficit. A weaker dollar would make U.S. goods and services more affordable to foreign buyers, potentially improving the trade balance. However, even in a free trade environment, this currency weakness is often temporary due to self-correcting market forces. Increased demand for U.S. products typically boosts demand for the dollar, ultimately driving its value back up. The use of tariffs to reduce the trade deficit can accelerate this process, as higher tariffs may also drive up U.S. inflation, potentially limiting the Federal Reserve’s ability to ease monetary policy.

Economic policy uncertainty, which surged to near-record levels in January, also tends to bolster the dollar. Even if tariffs are primarily a negotiation tactic for broader concessions, the resulting uncertainty can push investors toward safe-haven currencies like the U.S. dollar and the Swiss franc. While the global economy remains on solid footing, keeping our stance on the dollar neutral for now, a significant escalation in tariffs that disrupts economic recovery could drive the dollar even higher. Currencies most vulnerable to global policy uncertainty include the South African rand, the pound sterling, and the Mexican peso, while safe-haven currencies are more likely to gain in such an environment.

Want deeper insights and data to inform your strategy? Sign up for a complimentary trial of the NDR platform and explore our full range of research tools by completing the form to the right. Delve deeper into the dynamics shaping the economic landscape and offer actionable strategies for investors. Let us help you See the Signals.™ To subscribe to the NDR Blog click here.

Ned Davis Research, Inc. (NDR), or any affiliates or employees, or any third-party data provider, shall not have any liability for any loss sustained by anyone who has relied on the information contained in any NDR publication. The data and analysis contained herein are provided “as is.” NDR disclaim any and all express or implied warranties, including, but not limited to, any warranties of merchantability, suitability or fitness for a particular purpose or use. Past recommendations and model results are not a guarantee of future results. Using any graph, chart, formula or other device to assist in deciding which securities to trade or when to trade them presents many difficulties and their effectiveness has significant limitations, including that prior patterns may not repeat themselves continuously or on any particular occasion. In addition, market participants using such devices can impact the market in a way that changes the effectiveness of such device. This communication reflects our analysts’ opinions as of the date of this communication and will not necessarily be updated as views or information change. All opinions expressed herein are subject to change without notice. NDR, or its affiliated companies, or their respective shareholders, directors, officers and/or employees, may have long or short positions in the securities discussed herein and may purchase or sell such securities without notice.