Chart of the Week

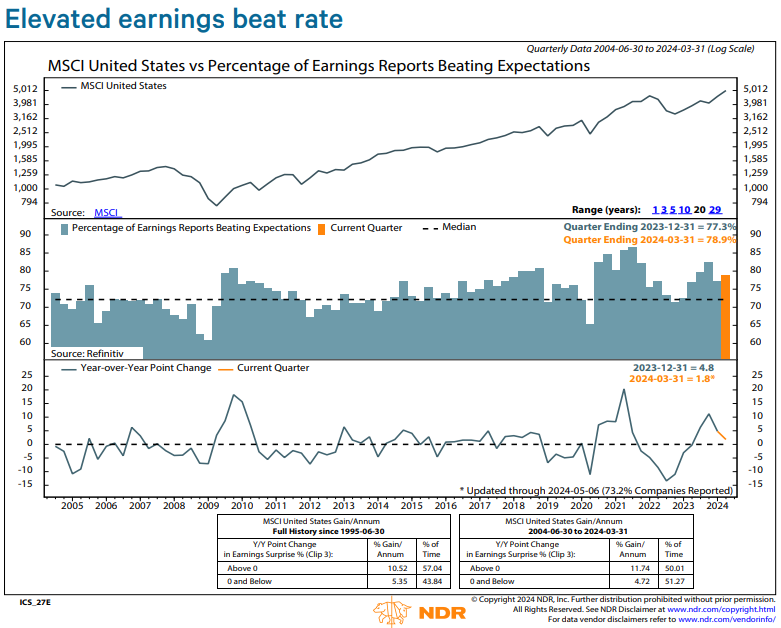

NDR: Elevated earnings beat rate

With concerns rising over the inflation outlook and the Federal Reserve's stance on rate cuts, bond yields saw an upward trend in March and April, while equities experienced a correction. The silver lining in this scenario is that these trends were fueled by the economy's resilience, leading to a significant number of first-quarter earnings reports surpassing expectations.

As the expectations for rate cuts have been adjusted following the initial optimism for multiple cuts in the future, the market has benefited from a positive earnings season. With 73% of component companies already reporting their first-quarter earnings, the MSCI U.S. Index has seen a beat rate of 79%, indicating a strong performance (as depicted in the middle clip). If this momentum continues, the year-over-year change for the quarter is projected to be positive, albeit slightly lower (as shown in the bottom clip), aligning with annualized returns exceeding 10%.

Stay tuned for more insights from NDR as we delve deeper into the dynamics shaping the economic landscape and offer actionable strategies for investors. Let us help you See the Signals.™