Chart of the Week

NDR: CPI/PPI Inflation Spread

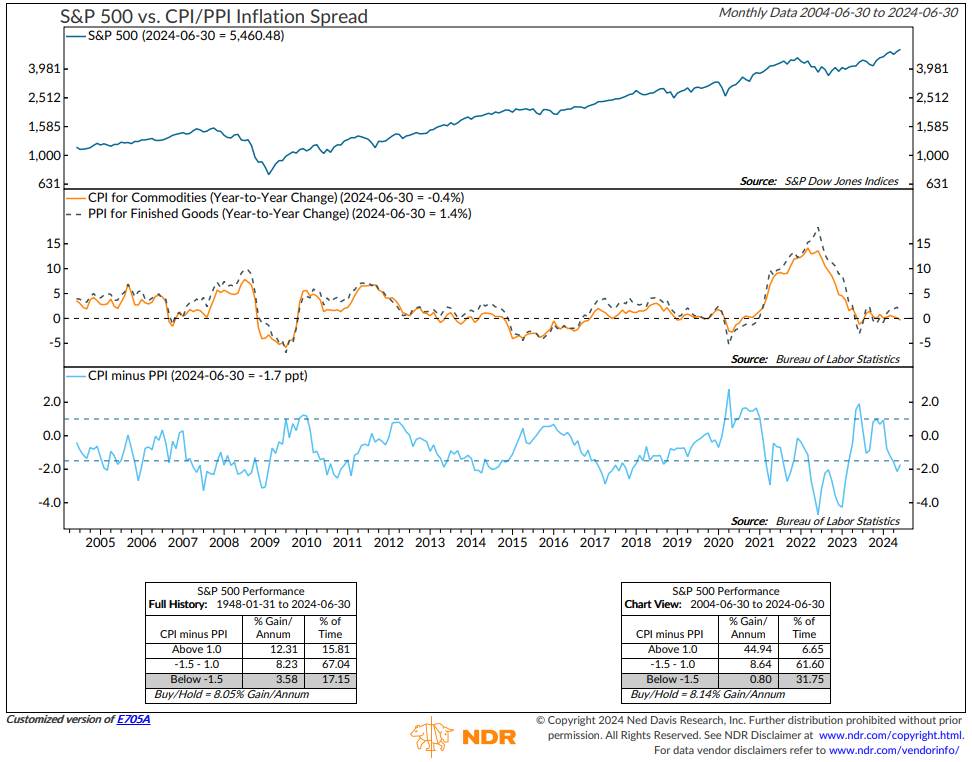

The recent CPI/PPI spread indicates potential downside pressure on earnings and stock prices. With CPI inflation coming in softer than expected and market expectations of a Fed rate cut rising, it's essential to be mindful of the risks ahead. While the economy seems to be on a path to a soft landing and the stock market remains bullish, the bloated earnings growth expectations for 2H 2024 are cause for concern.

The goods CPI/PPI spread, currently in a negative territory, suggests that cost pressures are outpacing selling price pressures. Historically, this has been a challenging environment for stock prices. As we navigate through these uncertain times, it's crucial to stay informed and prepared for potential market shifts. Stay updated on the latest economic indicators and market trends to make informed investment decisions.

Stay tuned for more insights from Ned Davis Research as we delve deeper into the dynamics shaping the economic landscape and offer actionable strategies for investors. Let us help you See the Signals.™